Present value of lifetime annuity

Using the above formula the present value of the annuity is. The formula for calculating the present value of annuity is as follows- PV P 1 - 1 r -n r Here P is the Periodic Payment r is the.

Ec Pazajfjqfwm

The present value of an annuity can be described as a series of cash contributions that are made over a specific period of time.

. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. In a simple annuity plan these. Helps people who own annuities or other regular cash streams discount their future value to estimate the associated present value.

Ad See If An Annuity Is Right For You. Ad Learn More about How Annuities Work from Fidelity. You can use the following formula to calculate the present value of an annuity.

Another difference is that the present value of an annuity due is higher. Understanding present value of an annuity The present value of an annuity is the cash value of all future annuity payments given the annuitys rate of return or discount. When calculating the present value of an annuity payment a specific formula is used based on the three assumptions above.

A series of payments which may or may not be made. The present value of an annuity is determined by using the. The tax law requires that you use these actuarial tables to value annuities.

Present Value PMT x 1 - 1 r -n r x 1 r Where PMT is the value of the cash flows r is the constant interest rate. PV present value of the annuity. Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market.

PV PMT l gi gi where. Thepresent value random variableis Y a K1 where K in short for K x is the. The present value of the annuity.

Begin aligned text Present value 50000 times frac 1 - Big frac 1 1 006 25 Big. Here is the present value of an annuity formula for annuities due. Present Value of Annuity.

The present value of an annuity is the current value of future payments from that annuity given a specified rate of return or discount rate. Understanding present value of an annuity The present value of an annuity is the cash value of all future annuity payments given the annuitys rate of return or discount. Ad Learn More about How Annuities Work from Fidelity.

Dont Buy An Annuity Without Knowing The Hidden Fees. Whole life annuity-due Pays a bene t of a unit 1 at the beginning of each year that the annuitant x survives. How to Calculate Present Value of Annuity.

The term net in net present value means to combine the present value of all cash flows related to an investment. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Annuity Present Value Calculator.

The actuarial present value APV is the expected value of the present value of a contingent cash flow stream ie.

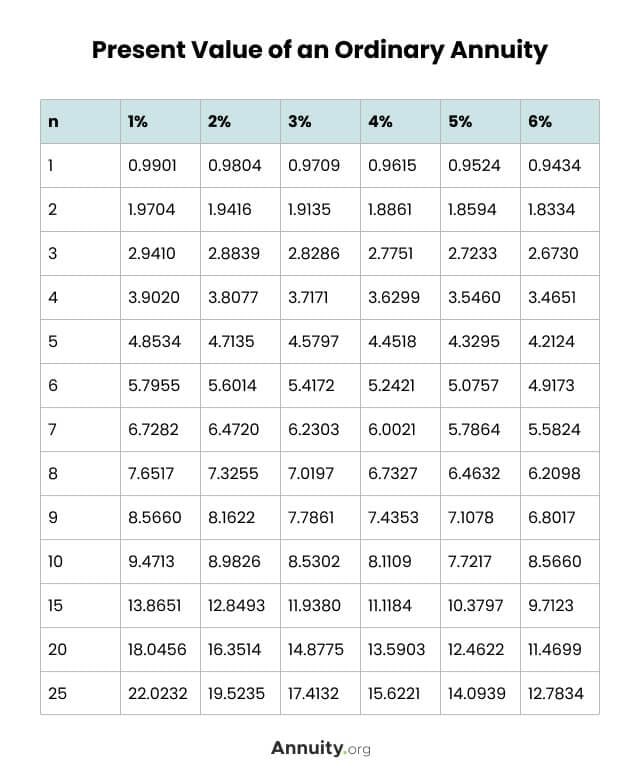

What Is An Annuity Table And How Do You Use One

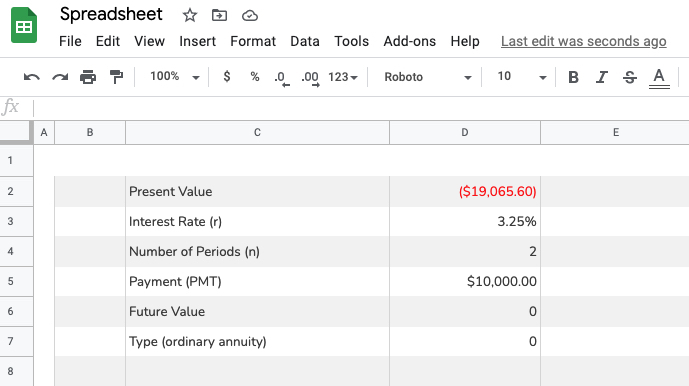

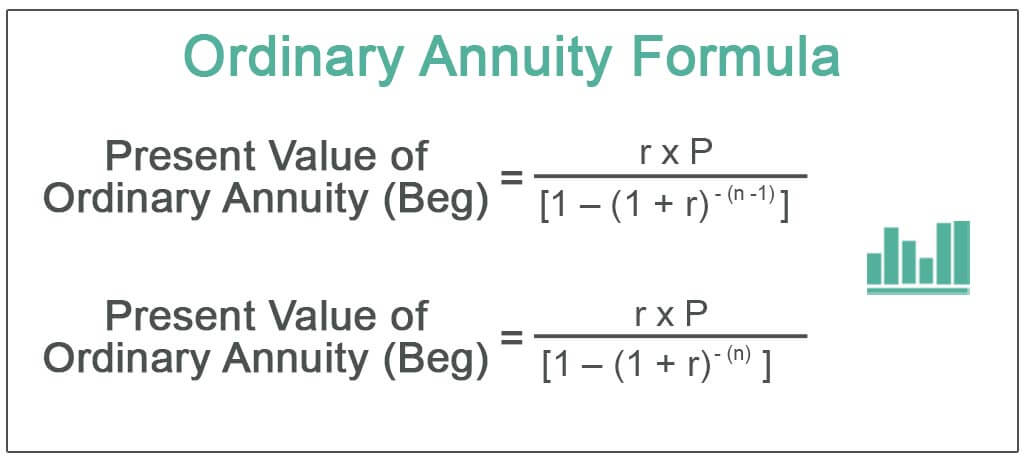

Ordinary Annuity Formula Step By Step Calculation

Present Value Of An Annuity How To Calculate Examples

Annuity Calculation In 9 Minutes Annuities Explained For Present Value Of An Annuity Formula Youtube

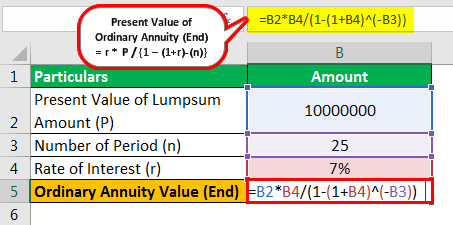

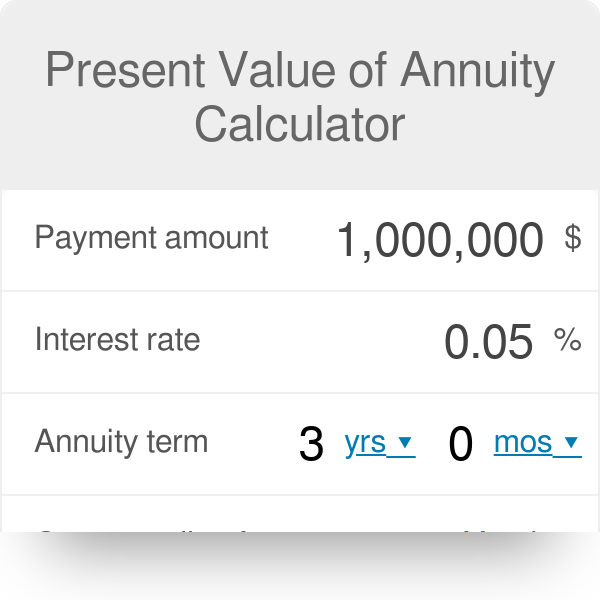

Present Value Of Annuity Calculator

What Is An Annuity Table And How Do You Use One

Ordinary Annuity Formula Step By Step Calculation

Present Value Of An Annuity How To Calculate Examples

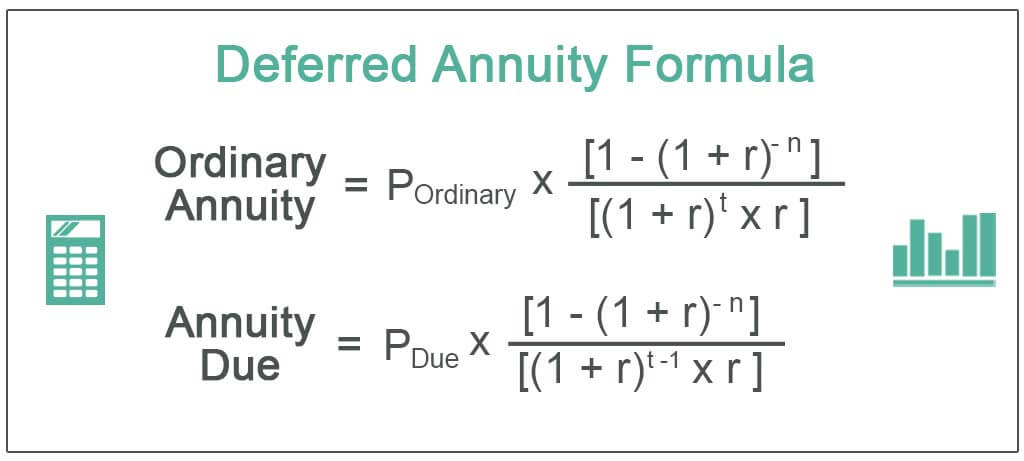

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity

Present Value Of An Annuity Definition

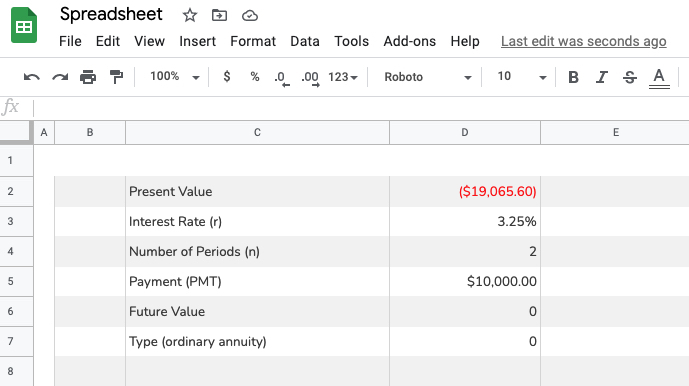

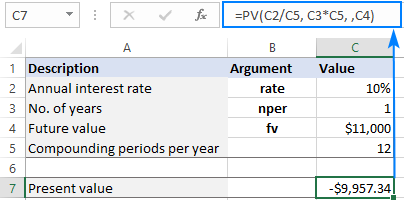

Using Pv Function In Excel To Calculate Present Value

Present Value Formula And Pv Calculator In Excel

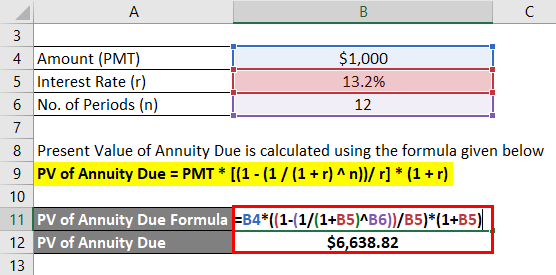

Present Value Of Annuity Due Formula Calculator With Excel Template

What Is An Annuity Table And How Do You Use One

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems

Present Value Formula Calculator Examples With Excel Template

Present Value Of Annuity Due Formula Calculator With Excel Template